Making New Years Resolutions Stick; My #1 Personal Finance Metric - 2-2-2 January 2024

2-2-2 is a monthly series that shares 2 top-of-mind ideas on the 2nd 2sday of every month - enjoy!

Thing 1: New Years Resolution Reminders

Every year on January 1st my wife and I do a ‘state of the union’ where we review our prior year against our prior year goals and set new goals for the upcoming year. We have categories like health/wellness, finances, socializing, the kids, trips, etc. The goals can loosely be categorized into habit building (read every night before bed) or one-off actions (take a course on AI). A few from my 2024 goal setting:

- Do skincare and probiotics every day

- 2 Duolingo lessons per day (almost 600 day streak with 2 kids under 2, not bragging but…je suis tres bien a francais)

- Write 12 blog posts (crushing it)

- Work out 3x/week even if its just 20 minutes

- Go on a date once per month out of our house

- Daily journaling/gratitude

Beginning-of-the-year me is always excited and ready to take on the world. Then work starts again, and the kids need to get to daycare, and families are visiting, and we also need to see friends, and then all of a sudden these goals hit the back burner until next year.

This year we are trying two things to keep our goals top-of-mind:

- Scheduled quarterly reviews - these are already on the wall calendar so we can’t forget, we will review the prior quarter and review what we wanted to accomplish and our progress. We will also probably realize that we want to remove some or add different ones because a lot can change in 3 months

- Physical reminder cards - I typed out a table of daily/weekly/monthly/general goals for myself and my wife, printed them out, and laminated them. They are in our bathroom next to our toothbrushes and are there to remind us of the things we should be doing. The hope is that simply having the goals visible in a daily traffic area will remind us enough that they become second nature to act upon.

Stay tuned for the update after our first quarterly 10-Q.

Things 2: The most important financial metric for our family

As part of our aforementioned goals, we do a financial review of the prior year. I diligently track every cent in to and out of our accounts in a custom-built app I’ve made. The challenge is that with so many numbers things can get overwhelming to track: we spent less in category X but we had to get a new roof but it also was a good year for stocks but groceries are more expensive….

The simplify, we care primarily about one north star metric: net income ex-investment returns (NI-exInv). Even better, we look at this as a percent of ex-investment income (NI-exInv%)

The formula for the number is: Total Income - Investment Income - Total Expense; for the percentage you then divide that by Total Income-Investment Income. All of our income is considered post-tax only.

This is our north star metric because it tells us how far below our means we are living, while factoring out the volatility of our investments (primarily stocks). For example, for an example total income of 100k, expenses of 60k, investment returns of 30k, you may look and say ‘wow great we made 40k this year because we made 100k and spent 60k’, but in fact 30k of that was driven by investment returns so in reality you are only living 10k below your means.

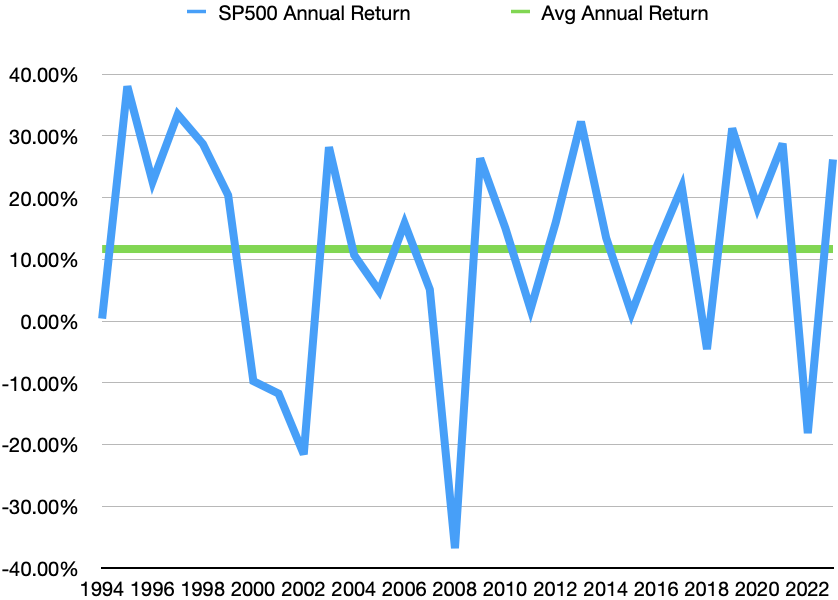

Over the past 30 years the SP500 has averaged 11.7% return (non-compounded), and in only 5 of those years has the actual return been within 5% of that number. Stocks go up and stocks go down, and most of us are buying stocks as a long term investment. Therefore, those investments should only be evaluated long-term, rather than caring about the volatile annual returns.

Our target NI-exInv is 35%, meaning on average we want to spend 65% of our ex-investment income and save 35%. This gives us cushion monthly for larger expenses while also allowing us to invest in our future.